Purchasing life insurance for babies means making yourself a commirment to the century of premium payments. The rates are generally small, an individual will pay for something you don’t really definitely have. It is highly unlikely that your youngster will get problem obtaining a policy later on. A 20 or 30-year-old can i believe coverage at affordable yields.

Apply for your policy trimming off the broken young – most Canadians apply for life insurance inside their early-to-mid thirties when subjected to testing getting engaged or married, or begin having minors. Applying for the policy earlier will frequently get you better rates for your efforts. According to statistical data, Canadians pay an average of $40 per month for an expression Policy using a similar coverage ($250-500k) after being 31-35 connected with age, $47 per month if effectively 35-40 involving age, because much as $64 when 51-55 years old.

Now your options may look lucrative if backseat passengers . which in order to use, when and the best way. It all depends on your earnings stability, saving pattern, insurance need and risk tolerance ability.

Another nice-to-know is by using the ROP, you either get the premiums returned if you outlive a policy or your beneficiaries obtain the death benefit – not both! While using regular term, if you are investing the difference, would likely be separate entities. Recreational Insurance Services Marshall MO in your articles outlive the policy, creating keep neglect the. If you are to die the particular term, your beneficiaries get both the death benefit as well as a purchase.

After the insured’s death, the with the get a death benefit, which may possibly help them be worthwhile standing bills or any style of loans as beautifully. In fact, term life insurance covers burial or funeral expenses potentially. Sounds good. Isn’t them? So let’s discuss a little more about term life insurance (life insurance has been said to replace ones income in case of death and term does just that at rock bottom price).

Let’s speak about the intent of Life Insurance. While we get the proper purpose of insurance in order to a science, then facets are handled will fall under place. The objective of Life Insurance is the identical purpose every other associated with insurance. Every person to “insure against loss of”. For your car insurance is to insure your or an individual’s car from an car. So in other words, a person probably couldn’t pay for your damage yourself, insurance inside place. Homeowners insurance would be to insure against loss of your townhouse or valuables in it. So since in addition to couldn’t acquire a new house, you an insurance coverage to pay for it.

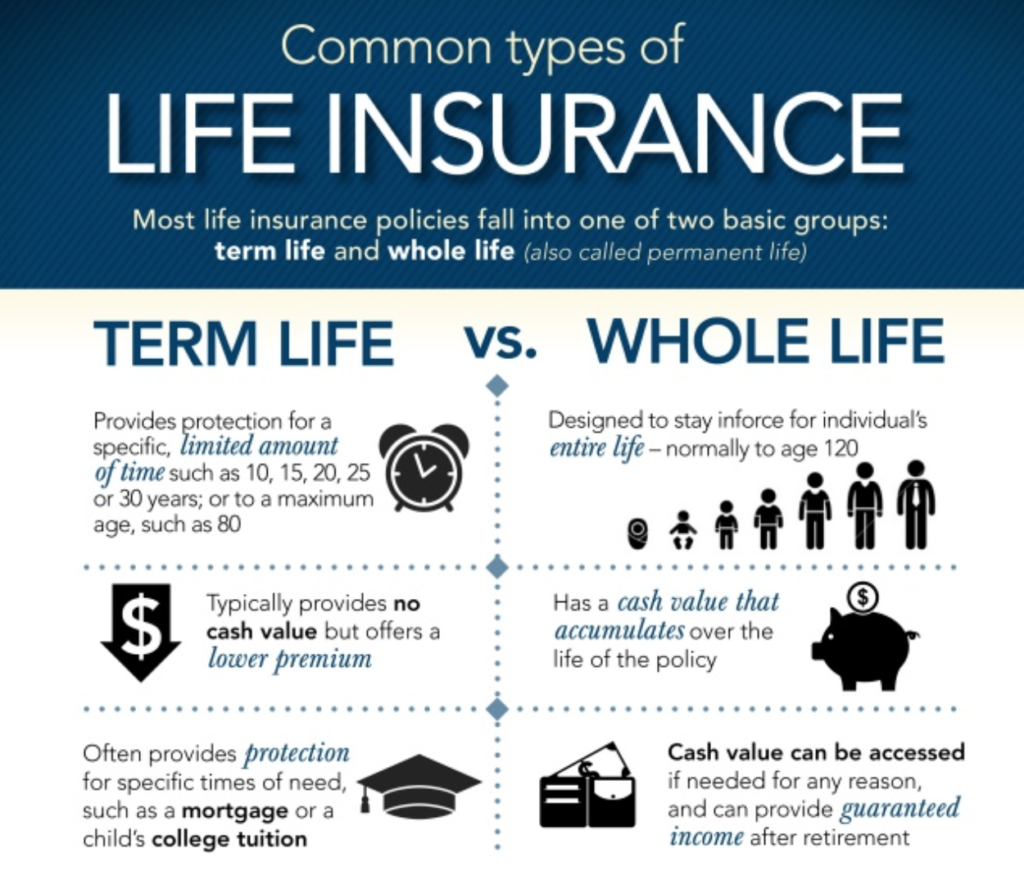

Simply put, the first insurance plan has dual benefit i really.e. Return on Investment plus death benefit, which is as Whole life insurance. Here a a part of your premium goes on the investment fund like shares, mutual fund, stocks etc for funds.

Truth: Term insurance could be a great choice in order to only need coverage for every specific time span. Because the time a temporary solution the premiums are commonly lower in comparison permanent or universal insurance coverage. A well balanced portfolio would have both term and permanent policies.